Global Environment and Society

Under our sustainability policy, we are implementing initiatives that take into account the conservation of the global environment and engagement with society. Specifically, we are monitoring energy consumption, reducing CO2, contributing to local communities, engaging with investors, and acquiring external assessments such as environmental certification.

Initiatives for Global Environment

We are striving to reduce energy consumption and GHG emissions by improving energy efficiency, reexamining the sources of procurement, introducing equipment that contributes to energy conservation, and enhancing the energy monitoring system mainly in the portfolio of DREAM Private REIT Inc. (DPR), which manages our assets, as shown below.

Energy Management

Goal of DPR

Medium-to long-term average reduction in energy consumption (basic unit basis) of 1% per year Reduce GHG emissions (on a per-unit basis) by 30% from 2016 levels by 2030

Achieve net zero by 2050

① Reduction rate of energy consumption per unit of production

18.4% (FY2021 / FY2022 results)

② Reduction rate of GHG emissions per unit of production

83.6% (FY2016 / FY2022 results)

When setting targets, we assume a reduction rate during normal operation.

Energy Performance Results

- Among our managed portfolio, in the calculation of the energy consumption intensity (MWh/M) and GHGemissions intensity (t/nf), we considered the occupancy rate for each asset type submitted to GRESB for whichenergy consumption is monitored.

- In calculating GHG emissions intensity, renewable energy use (including use of J-credits, etc.) and energy purchasing non-fossil certificates are excluded.

Goal of DPR

Disclosure of energy consumption

Promote use of LEDs for lighting

Goal of DPR

Achieve and maintain a 90% ratio(Total floor area base) of lighting LEDs by 2025

Replacement of air conditioners/introduction of refrigerant equipment with low global warming potential at the time of installation

- Lighting LEDs ratio (Total floor area base as of the end of May 2023)

- 86.5%

Introduction of refrigerant equipment with low global warming potential

Promote energy-sourcing by eliminating CO2

Goal of DPR

Achieve and maintain an 80% (Total floor area base) energy-procurement ratio by eliminating CO2 related to properties which DPR has management authority by 2025

- Properties which DPR has management authority

- 18

- Ratio of energy-sourcing by CO2 zero (Total floor area base as of the end of March 2023)

- 98.7%

Addressing Climate-Related Issues

Goal of DPR

Identifying, analyzing and disclosing climate change risks/opportunities in line with the recommendations of Task Force on Climate-Related Financial Disclosures (TCFD)

In addition, in some properties operated by DPR, shutters and stormproof boards are installed in preparation for a large-scale natural disaster in recent years. As part of our efforts to identify natural disaster risks, we list and disclose hazard information by property under management.

Right: Tidal protective board in front of the Machinery Room (Daikokuchou Logistics Center)

Other Initiatives

1. Environmental Risk Assessment at the Time of Acquisition of Properties

At the time of each fund’s property acquisition, we conduct risk assessment of soil contamination, asbestos, PCBs and other hazardous substances based on real estate appraisals and engineering reports, in addition to information disclosure and on-site surveys from sellers.

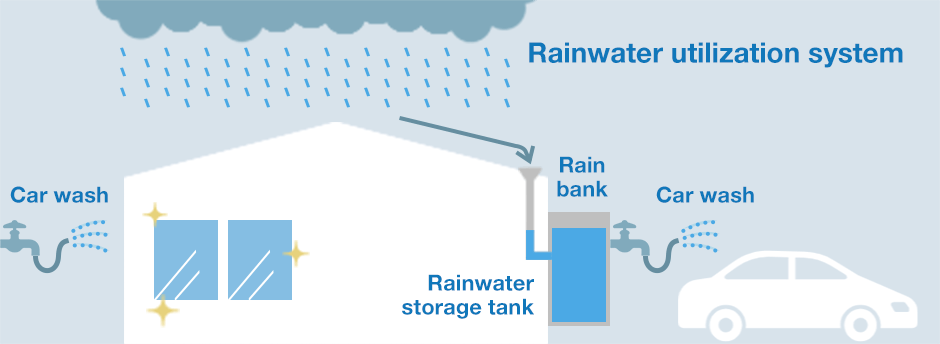

2. Introduction of rainwater utilization system

Certain properties owned by DPR have introduced a system that uses rainwater for planting and cleaning vehicles.

3. Encouraging tenants to save energy

At properties owned by DPR, as a measure to reduce environmental impact in cooperation with tenants, posters are posted in buildings requesting cooperation for saving electricity and recycling to raise awareness of the environment on a daily basis. In addition, even in the case of properties where utilities costs are borne by tenants, DPR is proactively providing information and making proposals regarding the reduction of GHG emission intensity and the hiring of electric power companies that contribute to the reduction of electricity prices, and has achieved some results.

4. Introduction of green leasing

At the properties owned by DPR, it is gradually introducing so-called green leasing, such as recommending the adoption of low-carbon materials and equipment with high energy-saving performance as an environmental measure integrated with tenants when operating and renovating facilities at exclusive part of the buildings.

5. Procurement of green loans

As of the end of March 2023, DPR had procured a total of thirteen green loans including loans that have been repaid and funded (total loan balance: JPY 12.7 billion; borrowing financial institutions: six).

In addition, the Green Finance Framework of DREAM Private REIT Investment Corporation, as defined by the DPR, has received the highest level of Green1 (F) in the JCR Green Finance Framework Assessment conducted by the Japan Credit Rating Agency, Ltd.

Outline of the Green Finance Framework of DREAM Private REIT Investment Corporation

| Item | Details |

|---|---|

| Target criteria |

Properties that have acquired or plan to acquire any of the following certifications by a third-party organization. ① Three to Five Stars in DBJ Green Building certification ② B+ to S ranks in CASBEE certification ③ Three Stars to Five Stars in BELS certification |

| Financing type | Borrowing (Loans)* *Borrowings are limited to the loan as private REITs cannot issue corporation bonds. |

| Uses of procurement funds |

|

| Unallocated fund management |

When the subject property is sold, etc., the loan will not be returned immediately, but instead is shifted to cover all the properties owned by DPR that meet the target criteria.

Specific methods

|

| Disclosure Policy |

|

6. Evaluation of ESG Initiatives by Property Management Companies

We check the status of ESG initiatives at each property management company that manages our properties under management and screen their qualifications as business partners.

7. Waste management

We monitor the amount of waste generated and the recycling rate on an annual basis.

We are striving to reduce waste through cooperation with tenants, etc.

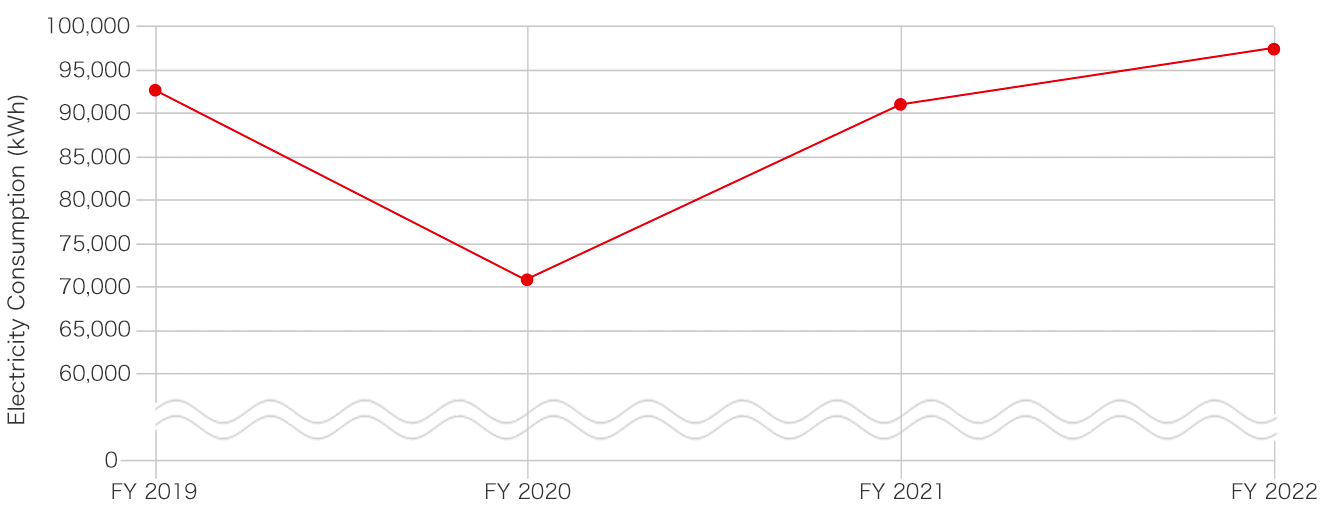

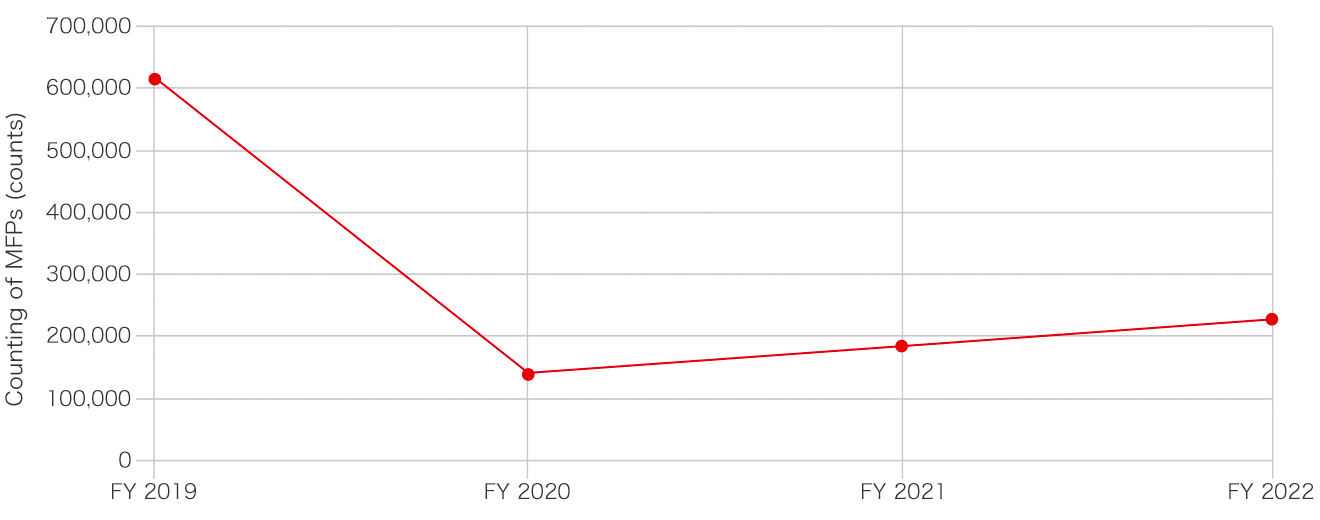

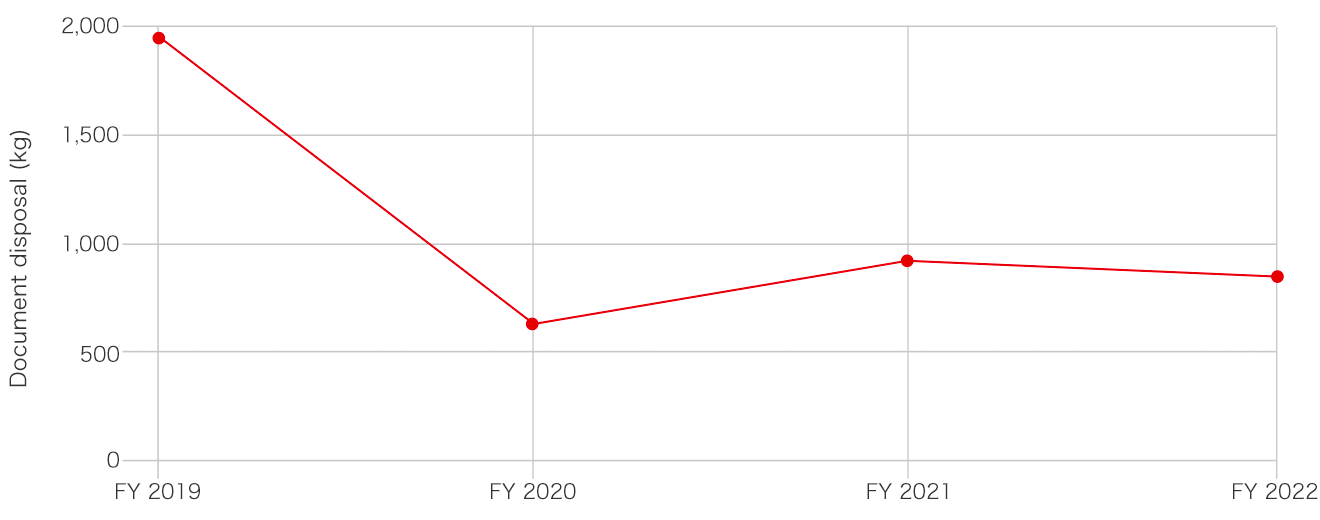

8. Reduction of energy, paper, and waste in our office

Since 2019, we have been monitoring electricity consumption, paper consumption (counting of MFPs) and document disposal in our office. We strive to reduce electricity consumption, paper consumption, and document disposal by turning off partial lights in each area at the time of leaving office and renting tablet devices.

Social initiatives

Collaboration with society

and stakeholders and information disclosure

We strive to collaborate with stakeholders such as tenants and facility users, business partners such as property management companies, and local communities when managing the properties of each fund.

We also strive to disclose information on sustainability to those stakeholders.In addition, we are strengthening our preparations for normal times and working on BCP (Business Continuity Plan) such as disaster prevention and disaster countermeasures.

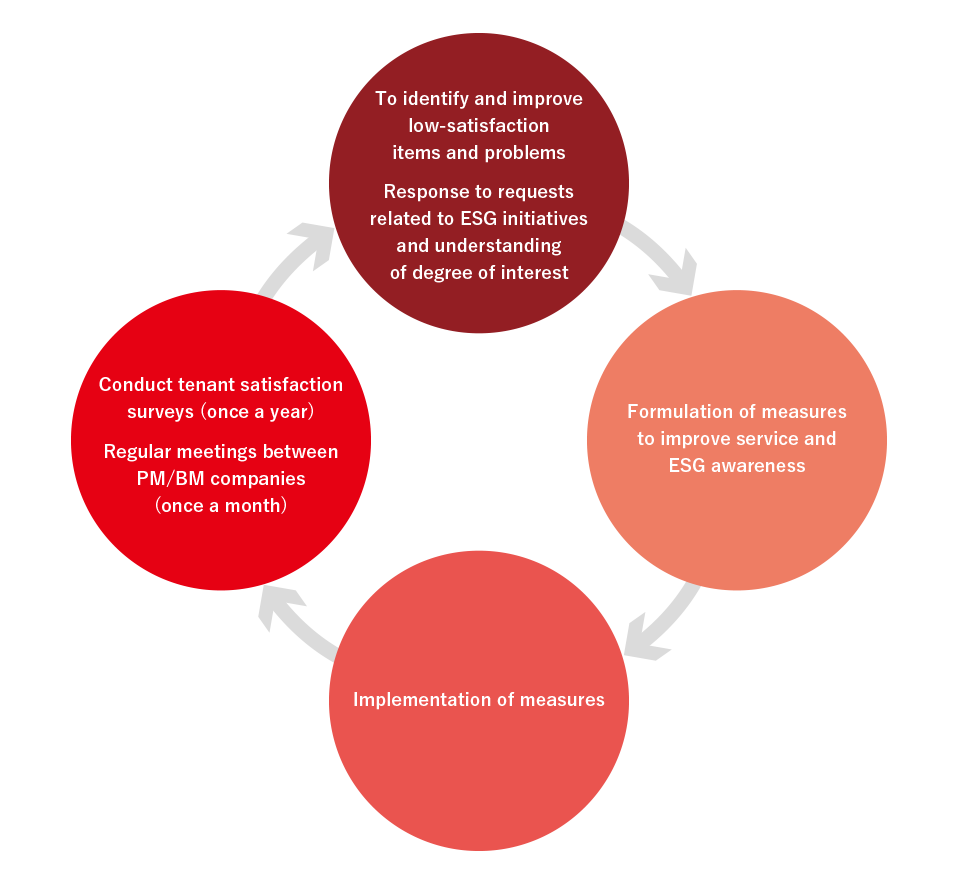

Collaboration with tenants and Satisfaction improvement

Goal of DPR

Regular implementation of tenant satisfaction surveys

Tenant Satisfaction Survey

We regularly conduct tenant satisfaction surveys to identify tenant requests and provide more comfortable facilities and services. In fiscal 2022, we began outsourcing this survey to an outside company to improve transparency.

Valuable opinions gathered through these surveys will be actively used to improve future satisfaction.

CSI (Customer Satisfaction) Factors

- Response of investment managers

- Response to emergencies (including earthquakes and typhoons)

- Response of PM company

- Indoor environment

- Response of BM company

- ESG-related initiatives

- Response in the event of defects

Ensure the security and comfort of tenants

Goal of DPR

Promote efforts to ensure tenant safety in preparation for disasters

Fire-fighting training and earthquake disaster training (once a year)

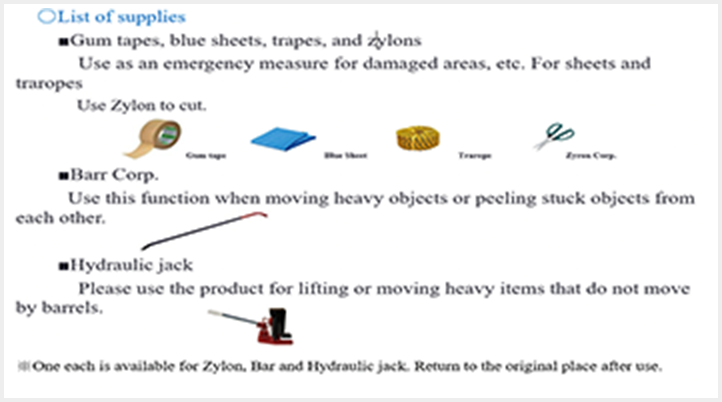

Strengthening the BCP system by preparing emergency equipment and BCP manuals, etc.

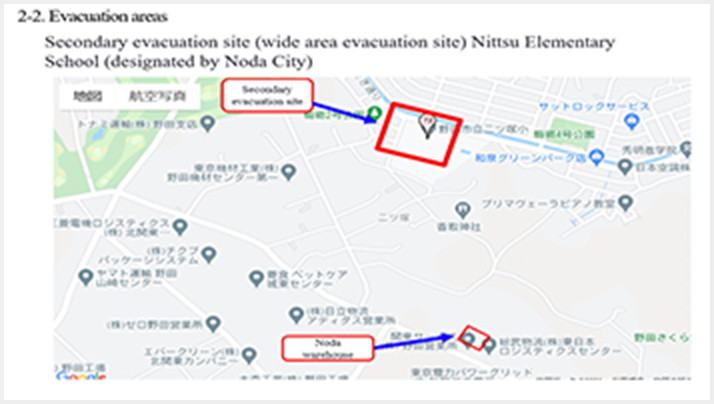

Right: BCP Manual/List of Emergency Equipment (Noda Logistics Center)

Right: Example of installation of emergency equipment (Shinano Unyu Urayasu Distribution Center)

Engagement with Local Communities

1. Implementation of events aimed at increasing contact points between tenants and end users at retail facilities

2. Active participation in regional consultative bodies

If there is a council for discussing local issues and matters that require joint response at the location of the property under management, we will actively participate as a management company after confirming the purpose.

3. Conclusion of Neighborhood Agreement for BCP Response with Neighboring Property Owners

We have concluded an agreement with the government as a temporary evacuation site in the event of a disaster and are contributing to strengthening the disaster prevention functions of the region.

4. Implementation of social contribution events, etc., utilizing vacant land in owned properties

5. Provision of information related to the COVID-19 crisis

We provide information on benefit support measures by the government and various organizations in order to support tenants.

Investor engagement

Goal of DPR

Conduct regular survey to DPR investors.

Investor Survey

We are conducting an investor survey with the aim of grasping property management policies and performance requirements and reflecting them in future investment and management strategies.

- FY2022 results: We conducted a satisfaction survey of DPR investors.

Active disclosure of ESG-related information

- Implementation of seminars for investors

- Expansion of disclosure information in the asset management report and the website exclusively for investors

Communication in COVID-19 crisis

- Online asset management reports and information exchange meetings

- Distribution of videos explaining financial results