Responding to Climate Change

Climate Change Resilience Policy

In response to climate change and climate-related issues, we support for the Task Force on Climate-Related Financial Disclosures (TCFD) and have established the following ”Climate Change Resilience Policy”.

Purpose

We recognize that climate change is an important (material) issue that causes dramatic changes in the natural environment and social structure and has a significant impact on our management and business as a whole. Recognizing this, we have established this “Climate Change Resilience Policy” (the “Policy”) as a policy for addressing risks and opportunities related to climate change and for addressing business and strategy resilience (Toughness and Power to recover) to climate-related challenges.

Our awareness of climate-related issues

We recognize the resilience of our operations to climate change and climate-related challenges as follows:

- As indicated in the Paris Agreement (2015), IPCC Special Report (2018), and IPCC Sixth Assessment Report (Working Group I, 2021), the progress of climate change is a scientific facts. Progress in climate change is a (material) challenge that brings dramatic changes to the natural environment and social structure and has a significant impact on our management and business as a whole.

- As a result of the progress of climate change, the occurrence and expansion of weather and climate disasters are expected, such as intensified typhoons and heavy rains, frequent heat wave and droughts, and ongoing global sea level rise. They could have a significant impact on our business.

- As a global effort to mitigate climate change, the transition to decarbonization of the socioeconomy is anticipated, such as establishment of a framework for reducing greenhouse gas emissions and strengthening of emission regulations. This change can have a significant impact on our business.

- Recognizing that climate change is a systemic financial risk, investors and many other stakeholders require to disclose information on climate-related risks and opportunities. Greater transparency, particularly through promoting climate-related risk disclosures in line with the recommendations of the Climate-Related Financial Disclosure Task Force (TCFD), is a significant challenge for us.

- Identifying, evaluating and managing climate-related risks and opportunities and enhancing the resilience of our operations are also critical to our ability to generate sustainable and stable long-term revenues in our real estate private fund operations (“our operations”).

Basic Policies and Commitments

Based on the aforementioned awareness , we have identified the following as our basic policies and commitments for climate change and resilience:

- We support the international targets set out in the Paris Agreement and work continuously to reduce greenhouse gas emissions in order to contribute to climate change mitigation.

-

[Governance] We have established a governance structure to address climate-related risks and opportunities associated with our operations as follows:

- The Chief Executive Officer for Climate-Related Issues shall be the President and CEO who is the Chairman of the Sustainability Committee, and the Executive Officer for Climate-Related Issues shall be the Managing Director COO.

- The executive officer responsible for climate-related issues regularly reports to the Sustainability Committee on matters relating to climate change responses, including the identification and assessment of impacts from climate change, the management of risks and opportunities, the progress of adaptation and mitigation efforts, and the establishment of indicators and targets. The Sustainability Committee deliberates and considers responses to matters that have been reported, as necessary, and then makes decisions based on the Sustainability Committee Guidelines. The executive officer responsible for climate-related issues reports regularly to the Board of Directors on the progress made in addressing climate-related issues.

- [Strategy] We establish and properly operate processes to identify, assess and manage the impact of climate-related risks and opportunities on our business, strategies and financial plans. For identification and evaluation of the climate-related risks and opportunities, we shall utilize the scientific and academic knowledge in a systematic and objective manner.

- [Managing Risks and Opportunities] By managing identified climate-related risks and opportunities and driving efforts to increase resilience, we seek to realize business risk reduction and value creation opportunities and to generate sustainable and stable revenues over the long term.

- [Metrics and Targets] We set indicators and targets for managing climate-related risks and opportunities, and with respect to indicators, we also pay attention to consistency between our operational strategies and overall risk management. Disclosure will also include the established targets and the results against the targets.

- We endorse TCFD recommendations and disclose climate-related information about our business to investors and other stakeholders in accordance with the disclosure framework recommended.

Our Initiatives for 4 thematic areas

based on the TCFD recommendations

Our initiatives for each areas of the TCFD’s disclosure recommendation, “Governance,” “Strategy,” “Risk Management System,” and “Metrics and Targets,” are as follows.

Governance

For information on our internal structure for promoting sustainability, please refer to the following.

Sustainability policy

Strategy

Scenario analysis

We adopted scenario analysis as a process for identifying and assessing climate-related risks and opportunities at DREAM Private REIT Inc. (DPR),which has commissioned us to manage its assets, and began scenario analysis for DPR’s assets under management in fiscal year 2022. The referenced external scenarios and their sources are as follows:

| Scenario | Envisioned World view | Reference Document |

|---|---|---|

| 4°C Scenario | Scenario in which the transition to a decarbonized society is not strengthened, and climate change-related disasters become more severe. |

IEA STEPS IPCC RCP8.5 |

| 1.5°C Scenario | Scenario in which the transition to a decarbonized society is socially reinforced and companies are expected to be more environmentally conscious. |

IEA NZE2050 IPCC RCP2.6 |

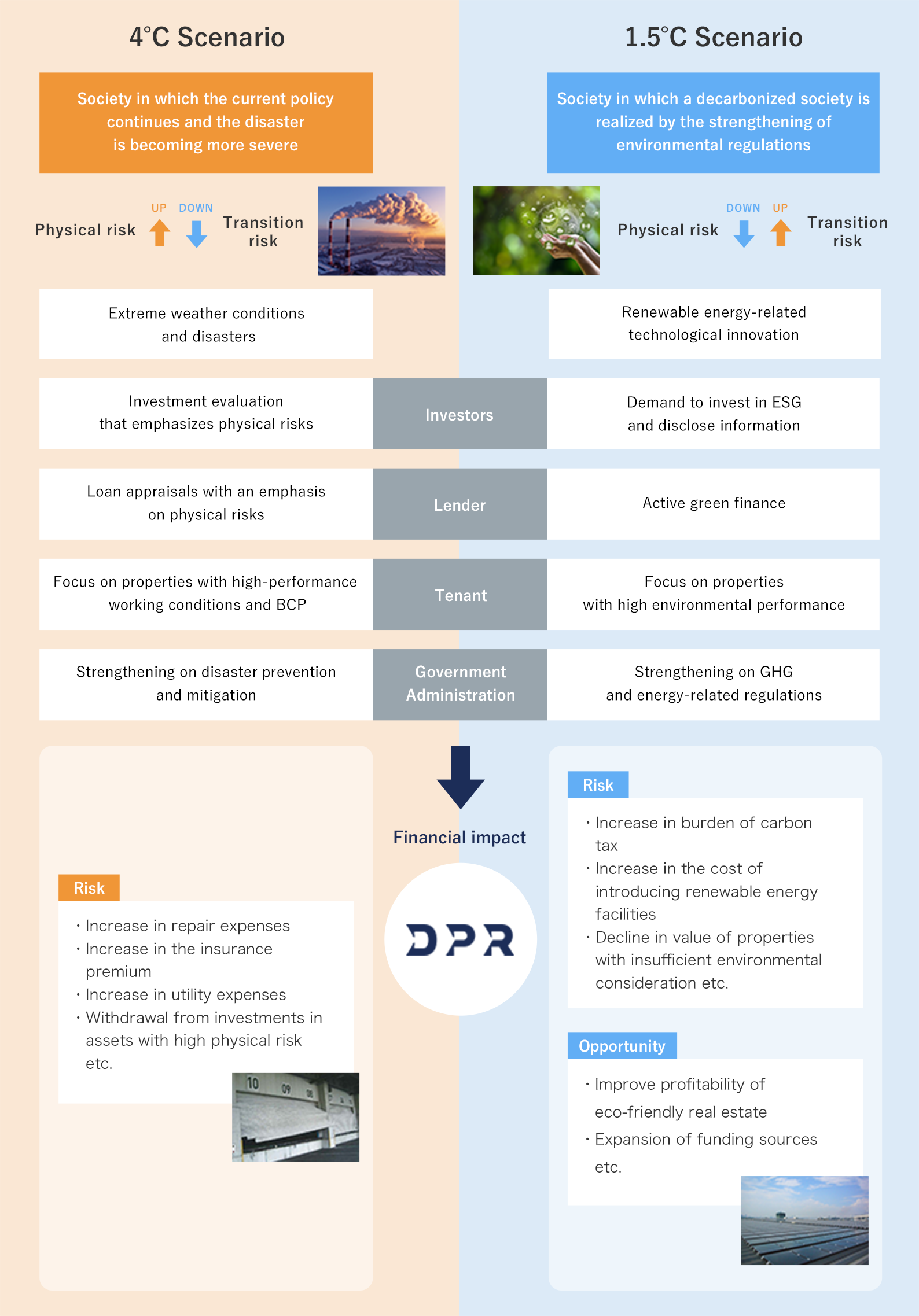

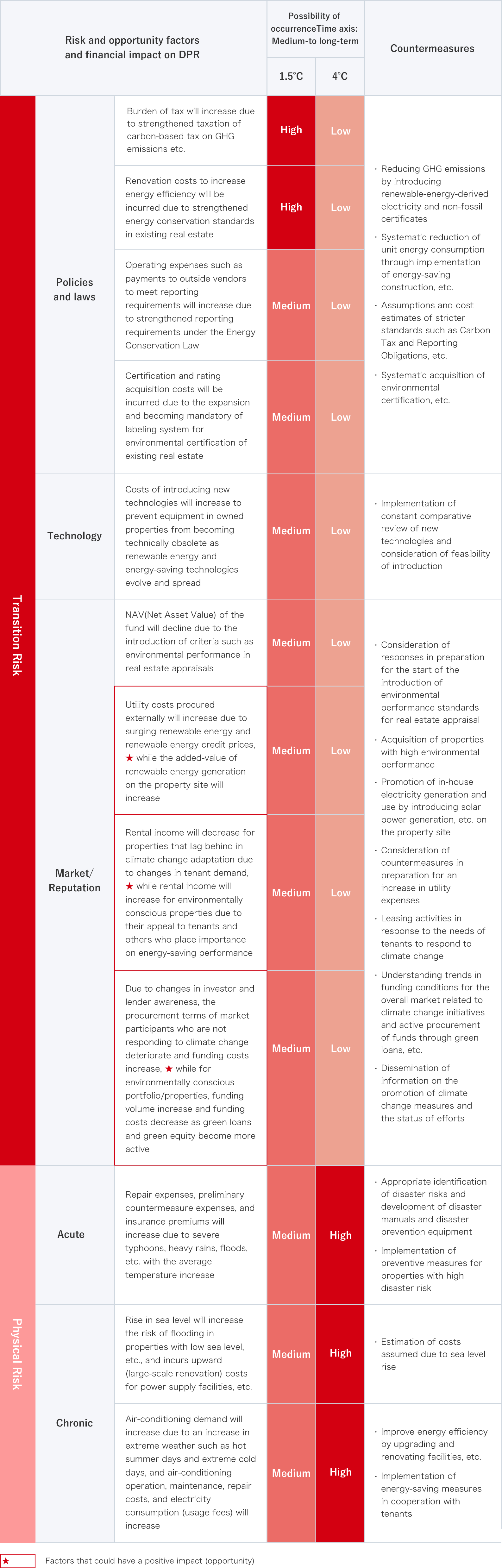

World view based on external scenarios

Identified risks, opportunities and countermeasures

Future actions

The above mentioned scenario analysis is at the stage of identifying potential risks and opportunities, and we will proceed with the analysis of specific financial impacts.

Risk Management System

Our risk management system for climate change is as follows.

Process of identifying and evaluating risks

In order to identify and assess climate-related risks and opportunities associated with our business, our executive officer in charge of climate-related issues forms climate-related working groups, as necessary, and identify the existence of such risks and opportunities based on the framework of transition risk and physical risk.

The executive officer responsible for climate-related issues reports the progress and results of the identification of such risks and opportunities to the Sustainability Committee as necessary, and the Sustainability Committee prioritizes risk management responses based on the results of its review of the certainty and impact of such risks and opportunities.

Risk management process

Climate-related risks and opportunities, which are of high priority in terms of business and financial planning, are implemented after the responsible department or personnel formulate countermeasures and deliberate them by the Sustainability Committee, etc.

Metrics and Targets

DPR intends to pursue its long-term goal of achieving net-zero GHG emissions by 2050 through its activities. DPR has also set a medium-term target of reducing GHG emissions per net sales by 30% from the fiscal 2016 level by 2030. In addition, by setting KPIs related to the introduction of energy efficiency improvement equipment, reexamination of electricity procurement sources, and acquisition of environmental certifications, etc., DPR is steadily implementing specific actions to achieve its goals. The appropriateness of the medium-term targets and KPI may be revised in light of the status of progress and the results of verification by third-party organizations.

DPR Goals

-

Goal

Medium-to long-term average reduction in energy consumption (basic unit basis) of 1% per year

Reduce GHG emissions (on a per-unit basis) by 30% from 2016 levels by 2030

Achieve net zero by 2050 -

Goal

Achieve and maintain a 90% ratio(Total floor area base) of lighting LEDs by 2025

Installation of refrigerant equipment with low global warming potential when renewing or installing air conditioning equipment -

Goal

Achieve and maintain an 80% (Total floor area base) energy-procurement ratio by eliminating CO2

related to properties which DPR has management authority by 2025 -

Goal

Achieve and maintain 80% (Total floor area base) of the total acquisition of environmental certifications, etc. (3★ equivalent or higher) by 2025.