Private REIT Business

DREAM US Private REIT* (DUPR)

In 2019, we began operating the first U.S. private REIT (a private REIT under U.S. tax law) as a Japanese real estate management company.

-

AUM

JPY 39.7 billion (as of end of June 2024, 1USD=140JPY)

-

Investment Strategy

Core

-

Fund Type

Open-End Fund

-

Investment target

Residential, logistics, student house etc. (Residential and logistics compose over 80% of total portfolios)

-

Major Investors

Domestic Investors and Mitsubishi Corporation

-

Characteristics of DUPR

-

1. The first U.S. private REIT by a Japanese real estate management company

This is the first private REIT under U.S. tax law formed by a Japanese real estate management company.

-

2. Pursuit of total returns for investments in U.S. real estate

The fund will invest in the properties that are located in the U.S. major markets where a stable employment and increasing demand for real estate are expected and will generate stable rental income over the long term, with the aim of realizing a total return, including both dividends during the period and increases in property value in long-term, due to rent increases.

-

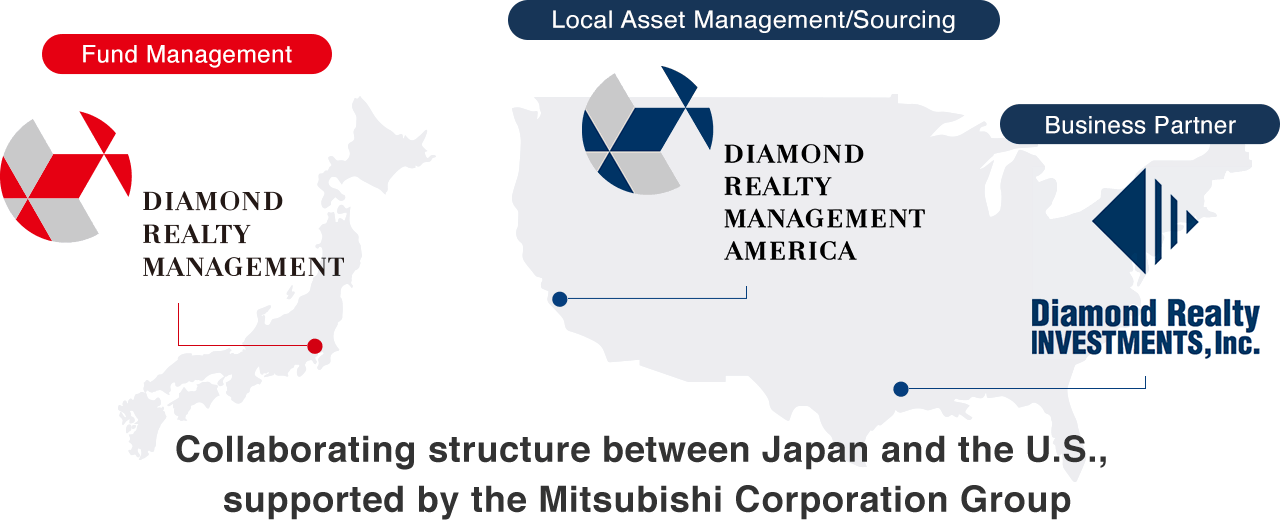

3. Stable asset management in collaboration with the subsidiary of Mitsubishi Corporation (Americas)

Diamond Realty Management America Inc., a 100% owned real estate management company of Mitsubishi Corporation (Americas), provides asset management services for properties owned by the fund and property acquisition services for the fund. In addition, the fund aims to achieve stable organic growth and external growth by collaborating with Diamond Realty Investments,Inc., a 100% owned real estate investment company of Mitsubishi Corporation (Americas), as a business partner.

-