Business in the U.S.A.

Closed-End Fund Business

Through our U.S. closed-end fund business, which we started in 2017, we leverage the Mitsubishi Corporation Group’s knowledge and experience in the U.S. real estate development business, to provide opportunities to domestic investors to invest in real estate in the U.S.

Leading track record

- Investment target

Residential, logistics, and student house etc.

- Investment Strategy

-

Development, Build to Core*and others

*The fund aims to possess high-quality operating properties that achieve relatively high profitability compared to the case of acquiring the property after completion, by acquiring the target property from the development stage and holding it as an income-producing property for a certain period of time after completion of construction, at a cost close to the development cost. - Fund Type

Commingled Fund, Separate Account

- Major Investors

Financial institutions, Non-financial Organizations etc.

Mezzanine Debt Fund Business

In 2018, we started a Mezzanine Debt Fund business in the U.S. utilizing the Mitsubishi Corporation Group’s knowledge and experience in the U.S. real estate development business, and the track record of our domestic Mezzanine Debt Fund business as well. Mezzanine debt, which are generally middle-risk, middle-return investments as compared to equity investments, may become one of the entry points when domestic investors start investing in U.S. real estate.

Leading track record

- Investments target

U.S. mezzanine debt, U.S. preferred equity investments

- Collateralized asset

Residential, retail, office, student house, logistics, complex and development

- Fund Type

Commingled Fund, Separate Account

- Major Investors

Financial institutions, Non-financial Organizations and Mitsubishi Corporation

Private REIT Business

DREAM US Private REIT*(DUPR)

In 2019, we began operating the first U.S. private REIT (a private REIT under U.S. tax law) as a Japanese real estate management company.

Leading track record

- Investment target

Residential, logistics, etc.

- Investment Strategy

Core

- Fund Type

Open-End Fund

- Major Investors

Financial institutions, Non-financial Organizations and Mitsubishi Corporation

U.S. real estate investment track record

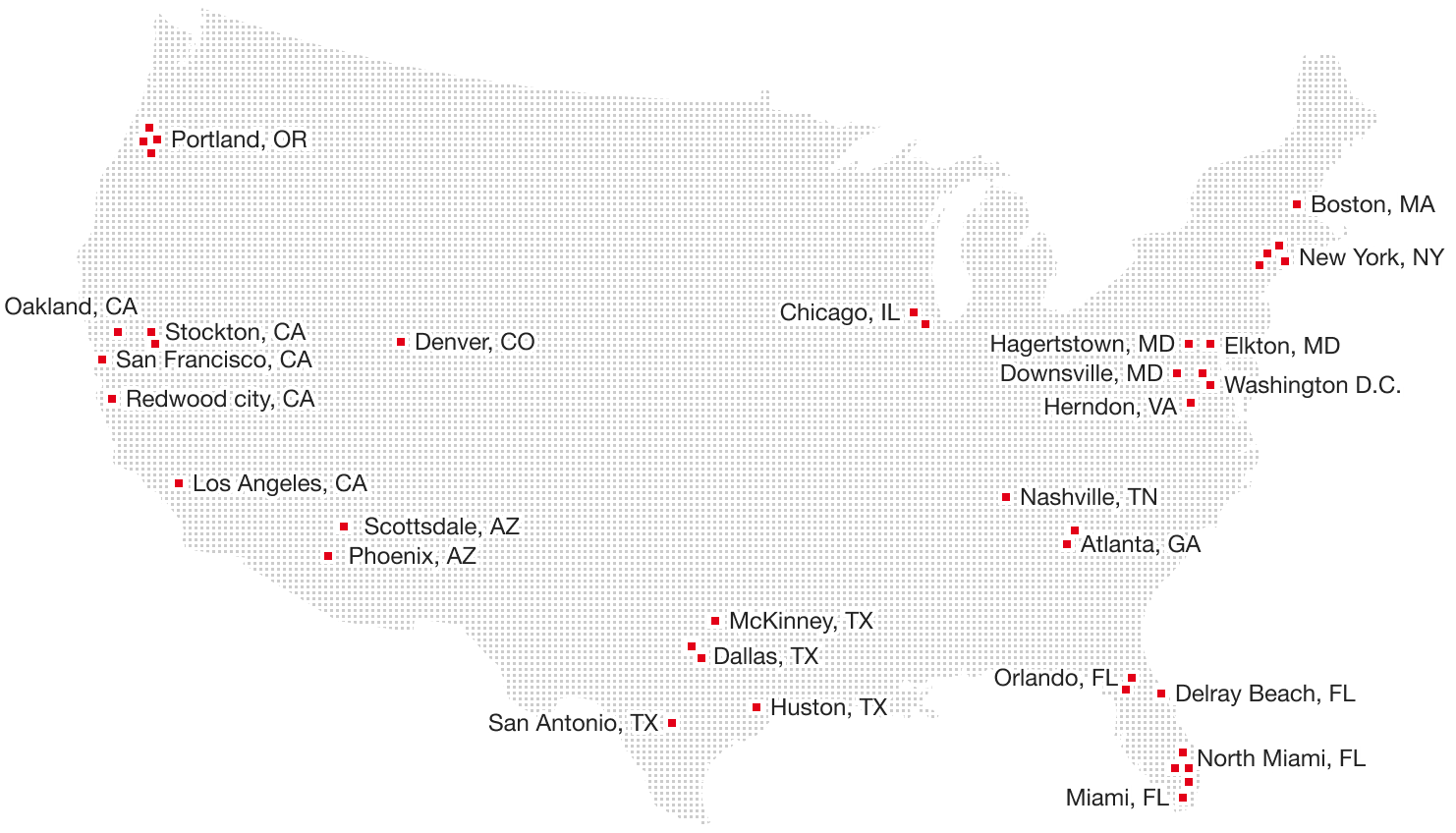

Our company has a track record of investing in many properties (including those under development) located in cities across the United States.

Property Location

*As of end of July, 2024

Diversification (equity basis)

*As of end of July, 2024- Residential

- 64%

- Logistics facilities

- 23%

- Offices

- 12%

- Student apartments

- 1%

- Total Equity

- about1,126million dollars